Water Damage Claims and Your Home Policy

Does the sound of water running in your home set off your internal alarm bells? It should; each day, about 14,000 people in the United States have a water damage emergency in their home.

Besides potentially creating a huge mess to deal with, water damage caused by accidental discharge or overflow from plumbing or appliance malfunction is expensive to remediate and repair (the average cost is about $10,900 ) – and it may not be covered by your home insurance. A recent study even shows that water damage claims in excess of $500,000 have doubled in the past few years.

That’s a daunting sum and it’s even worse when the damage is caused by weather-related flood waters outside of your home – the Federal Emergency Management Agency estimates just one inch of floodwater in your home would cause $25,000 in damage.

So, what to do?

Know what your home policy covers

Your home insurance will usually cover water damage that occurs from a source inside the home. That means that damage caused by water from the following sources would likely be covered (to the applicable policy limit):

- Appliance leaks or malfunctions

- Burst or cracked pipes

- Plumbing leaks

If rain enters your home due to damage caused by a peril your policy covers, your home insurance policy would likely provide coverage for the ensuing damage. For example, if high-speed winds rip off a portion of your roof and rain enters the now-uncovered space, that water damage would typically be covered. The same coverage would apply if a window on your house is broken by vandals and rain enters through the broken window.

When you need an endorsement

“Out of sight, out of mind” is a major mistake when it comes to cellars and basements. They’re often overlooked when homeowners think about insurance, but a whopping 98% are likely to experience water damage. Your best bet is to make sure you have coverage for two common causes of loss: sewer pipe backup and malfunctioning sump pumps.

Blocked or damaged sewer pipes can flood your property with noxious gases, fluids, and solids, and it costs about $25,000 to remediate and repair the damage. Since most homeowners policies do not cover damage caused by sewer pipe backup, you’ll need to get this coverage from an endorsement attached to your homeowners policy. If you have a sump pump, that’s great. But if it overflows or malfunctions, you are likely out of luck in regard to insurance coverage, so an endorsement would be needed.

The solution to basement and cellar flooding expenses

Fortunately, there’s an endorsement to your policy that will cover both causes of loss. The Water Backup and Sump Discharge or Overflow endorsement offers protection for basement and cellar flooding if your sewer utility line backs up into your home or your sump pump can’t keep up with an influx of water. You can select from a variety of coverage amounts based on the amount you estimate it would take to remediate the damage and repair your property. This is a relatively inexpensive coverage that’s easy to add to your policy.

Flood coverage from the NFIP

Property damage from groundwater, such as floods caused by rain, overflowing lakes, ponds, or streams, would not be covered by your homeowners policy, nor would flood damage caused by storm surges or high tides.

Even if you don’t live in an area at high risk for flooding, you should consider flood insurance from the National Flood Insurance Program (NFIP). Floods are the leading cause of property damage in the United States, and about 20% of all flood claims come from areas outside high-risk zones. These free tools from the Federal Emergency Management Agency will give you a realistic idea of how flood prone your property really is and an estimate of how much it would cost to repair flood damage to your property.

FEMA Flood Map – find your property’s risk of flooding.

FEMA flood damage cost calculator – get an estimate of the cost to repair damage to your home.

What to do now

Consider adding a Water Backup and Sump Discharge or Overflow endorsement to your homeowners policy to make sure your cellar or basement is covered for flooding. Make sure to ask about Flood coverage for your home, too. Our Risk Coaches are licensed insurance professionals who are glad to help you navigate the often-perplexing world of insurance coverage. Call us at 800.342.5342 Monday through Friday, from 8:00 a.m. to 8:00 p.m. ET.

If there are discrepancies between the information on this site and the policy, the terms in the policy apply. Electric Insurance Company Risk Coaches help you assess your current coverages and exposure to risk based on the information you provide during your discussion with them. The services provided are for informational purposes only and do not create a professional or fiduciary relationship. Incomplete information or a change in your circumstances after your meeting may affect coverage requirements or recommendations.

Product, service, program, credit, and discount availability and limits vary by state. The information provided on this site is provided for informational purposes only and is not a full explanation of products, services, or coverage. For more information, please contact Electric Insurance Company at 800.227.2757.

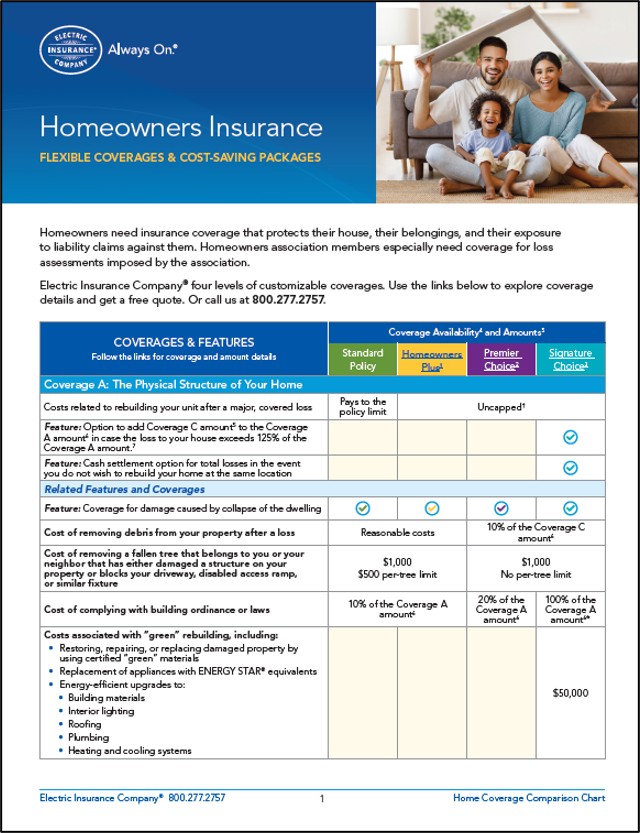

Home values are at an all-time high. Make sure you protect your investment in your home with sound coverage. This easy-to-understand coverage chart (PDF 820kb) helps you know what to get and why.